Explore Project Activity on the Superchain

The goal of this tutorial is to dip your toes into OSO's blockchain event table and see how you can use it to answer questions about different project cohorts' activity on the Superchain.

You can find the code for this tutorial here.

Getting Started

New to OSO? Check out our Getting Started guide to set up your API access.

Before running any analysis, you'll need to set up your environment:

from dotenv import load_dotenv

import os

from pyoso import Client

import pandas as pd

load_dotenv()

OSO_API_KEY = os.getenv("OSO_API_KEY")

client = Client(api_key=OSO_API_KEY)

Step 1 — Tag Contracts in OP Atlas

The CTE below grabs every contract address that has ever been attached to an OP Atlas project and flags the ones that signed up for the April 2025 snapshot of Retro Funding.

OP Atlas assigns a unique round_id for each round of funding. The one we're interested in is "8" - and specifically the third snapshot. We've bundled this into a collection called "8-3".

Here is the query to lookup all contracts in OP Atlas that are relevant to the "8-3" snapshot.

SELECT

abp.artifact_id,

MAX(

CASE WHEN pbc.collection_name = '8-3' THEN TRUE ELSE FALSE END

) AS is_retrofunded

FROM artifacts_by_project_v1 AS abp

LEFT JOIN projects_by_collection_v1 AS pbc

ON abp.project_id = pbc.project_id

WHERE abp.project_source = 'OP_ATLAS'

GROUP BY 1

The result is that each artifact_id (a unique contract address + chain combination) now carries a boolean is_retrofunded.

We'll use this query to join the results to the blockchain event table next.

Step 2 — Pull Daily Contract Invocations

Now we will pull the daily contract invocations for the month of April 2025. It's slow and expensive to query raw blockchain data, so we'll use the int_events_daily__blockchain table. This table already aggregates unique tx-hashes per contract, per day, so the query stays snappy even for month-long windows. The table includes a couple different event types and metrics, but we'll focus on CONTRACT_INVOCATION (top-level transactions).

df_events = client.to_pandas("""

WITH projects AS (

-- (same CTE as above)

SELECT

abp.artifact_id,

MAX(CASE WHEN pbc.collection_name = '8-3' THEN TRUE ELSE FALSE END)

AS is_retrofunded

FROM artifacts_by_project_v1 abp

LEFT JOIN projects_by_collection_v1 pbc

ON abp.project_id = pbc.project_id

WHERE abp.project_source = 'OP_ATLAS'

GROUP BY 1

)

SELECT

e.bucket_day,

CASE

WHEN p.is_retrofunded = TRUE THEN '1 - Retro Funded'

WHEN p.is_retrofunded = FALSE THEN '2 - In Atlas'

ELSE '3 - Other'

END AS cohort,

SUM(e.count) AS txn_count

FROM int_events_daily__blockchain e

LEFT JOIN projects p

ON e.to_artifact_id = p.artifact_id

WHERE e.bucket_day BETWEEN DATE '2025-04-01' AND DATE '2025-04-30'

AND e.event_type = 'CONTRACT_INVOCATION'

GROUP BY 1, 2

ORDER BY 1

""")

The result is a dataframe with the following columns:

bucket_day: The day of the month.cohort: The cohort of the contract (Retro Funded, Atlas-only, Other)txn_count: The number of contract invocations for that day.

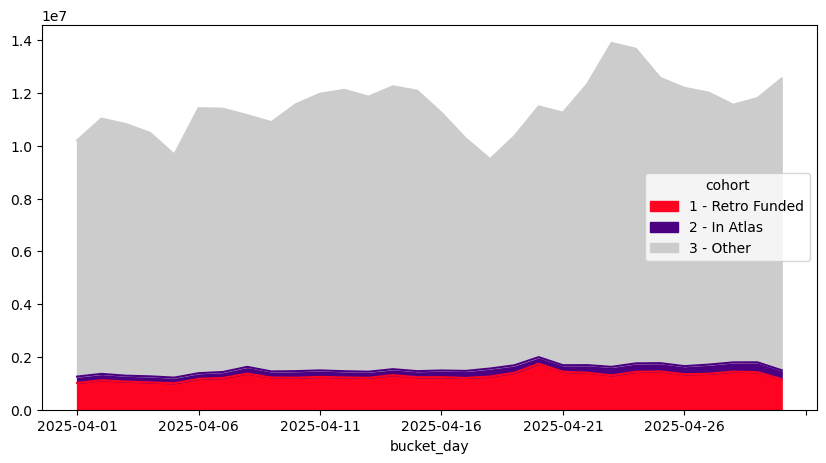

We'll use this dataframe to create a chart of the trend in contract invocations by cohort.

Step 3 — Visualise the Trend

We'll use the pivot_table method and then create a very simple chart of the trend.

(

df_events

.pivot_table(

index = "bucket_day",

columns = "cohort",

values = "txn_count",

aggfunc = "sum",

fill_value = 0,

)

.plot(

kind = "area",

figsize = (10, 5),

color = ['#ff0420', 'indigo', '#ccc'], # Retro Funded, Atlas-only, Other

)

)

The units in the Y axis are the number of contract invocations. From this, we can see that the majority of contract invocations do not come from OP Atlas projects. However, the majority of contract invocations that are from a known project are indeed being Retro Funded.

Next Steps

- Drill into gas fees — swap

SUM(e.count)forSUM(e.gas_fee)to see cost share. - Extend the window — change the

bucket_dayfilter to explore seasonality. - Surface unmapped heavy hitters — export the top “3 - Other” contracts and invite them to OP Atlas.

You can find the code for this tutorial here.

Happy querying! 🎉